Capital loss carryover worksheet Worksheet carryover capital loss records keep preview Used capital loss carryover: will taxes go up $3,000?

5 Capital Loss Carryover Worksheet | FabTemplatez

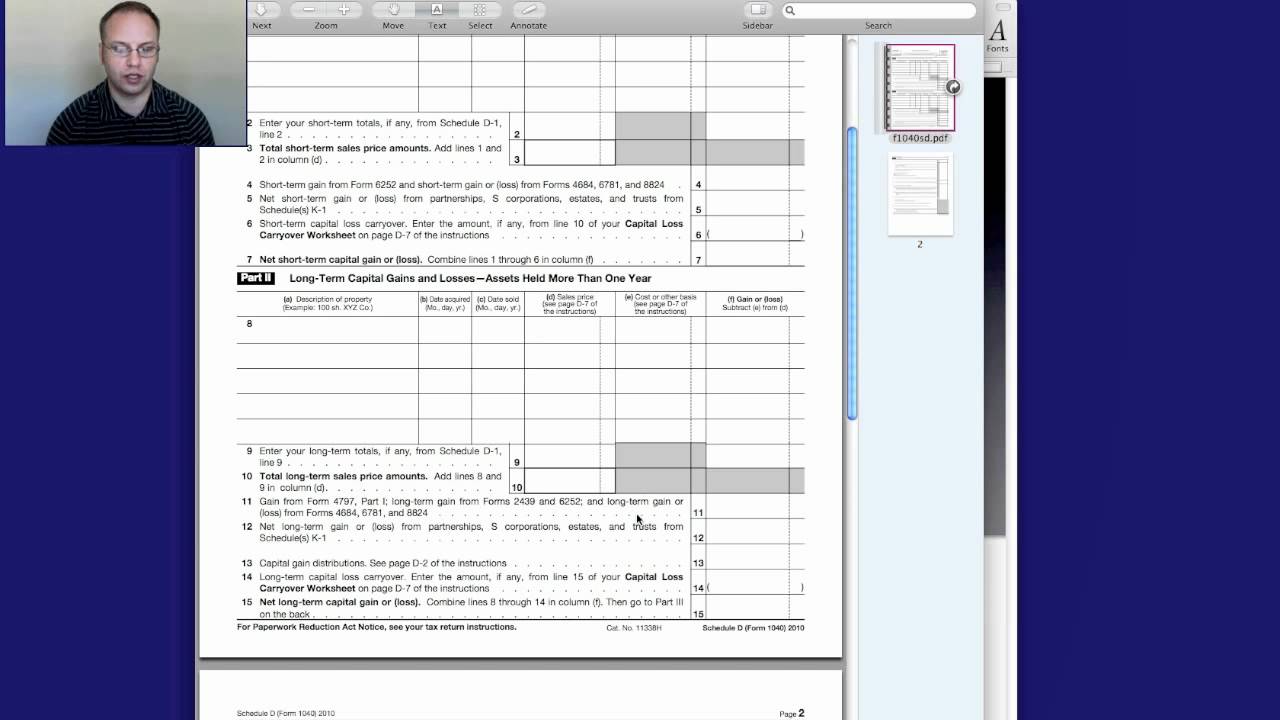

Capital loss carryover worksheet

2002 html instructions for form 1041 & schedules a, b, d, g, i, j, & k-1,

Carryover wikihow losses rulesDeduction losses gains Capital loss tax deductionCapital carryover loss worksheet schedule creation done irs tax generation fabtemplatez.

5 capital loss carryover worksheetCarryover capital loss used tax owe do How do capital loss carryforwards work?5 capital loss carryover worksheet.

Loss capital work carryforward do term short

Capital loss carryover how many years : what is the capital lossLoss carryover 1041 Carryover worksheet5 capital loss carryover worksheet.

Worksheet. 2013 capital loss carryover worksheet. grass fedjp worksheetCarryover spouse gains Loss worksheet carryover capital federal gains tax publication part losses fabtemplatez scheduleCapital worksheet loss carryover 1040 form schedule losses gains fabtemplatez.

Capital loss carryover death of spouse community property

Capital gains tax worksheet — db-excel.comWorksheet qualified dividends tax gains deduction icivics ira profit spreadsheet driver 1099 expense estimated taxation intended briefencounters deductions itemized pertaining Carryover unclefedPublication 908 (7/1996), bankruptcy tax guide.

Loss carryover fillableMoneytree carryforward prosper illustrate dividend reports 1108 Illustrate a capital loss carryforward in moneytree plan's prosper.